On Saturday we visited the Stone Zoo for the first time as guests of Fidelity and MEFA. It was the cutest event: Kids wore their Halloween costumes, and we went around the zoo viewing the animals – but also trick-or-treating! I was impressed at how many parents dressed up, too.

E was pretty thrilled to see four (!) other little girls in the same costume as her. I guess that’s what happens when your glittery butterfly outfit comes from a big store (hah)!

MEFA was part of the event, giving out information on setting up a college savings plan for kids as part of their U.Fund Dreams Tour. Their booth was full of kids coloring, getting their photos taken, and just having a good time!

After the event I was talking with my sister about setting up a 529 college savings plan for her new baby. The holidays are coming up, and it’s a really good thing to have in place for gifting. We really appreciate when our family members put money into E’s account vs. buying her more toys… it’s a gift that really will just get better with time!

I didn’t have a 529 (I don’t think most people born in the 80s did?), so I came out of college with a LOT of debt. One of the financial priorities we have set is to save money so that E doesn’t have to worry about student loan debt. We have it set up to automatically withdraw money each month, so we don’t even really see it happening – and BAM her savings account already has a good amount in it!

We also have a link we can share with family and friends for holidays and birthdays, which has helped her account grow. I appreciate that we are fortunate enough to be able to do this for her, but the wonderful thing is that every little bit makes a difference. Just think about how much money $5 will be in 20 years if you invest it now. You can use the MEFA College Planning Tool on their site to see what plan might work for you.

We have had a 529 plan for E since she was a baby, so we’re probably more well-versed in them than most people. I want to share why they’re a good idea, in case you don’t have one yet!

Why you should set up a 529 plan for your child

You don’t have to be a MA resident.

You do have to be a citizen or permanent resident of the US, but anyone can open a U.Fund! You can open an account for your child, your nephew, your best friend’s child, even yourself.

It’s not just for college tuition.

If you’re not sure your child will go to college, you really don’t have to worry. Under the MEFA U.Fund (the Massachusetts 529 college savings plan), you have a lot of flexibility. Aside from the tax benefits (talk to your tax accountant about this!), you can use up to $10,000 per year on K-12 tuition expenses. If your child decides not to go to college and you don’t have any of these other expenses, you can actually change the beneficiary and still use the money.

You are not taxed to withdraw money.

Withdrawals are tax-free when used for qualified education expenses, like tuition, books, room and board, and required supplies and equipment. For K-12 institutions, qualified expenses are tuition only, whether it’s public, private, or religious.

You could get a tax deduction.

MA residents saving in the U.Fund can claim a state income tax deduction of $1,000 or $2,000 (filing single or married filing jointly, respectively).

You can open an account with any amount.

You don’t have to have a huge amount of money saved already to open a 529 plan. You can open a U.Fund account with any amount!

There is a lot more information here on the MEFA site!

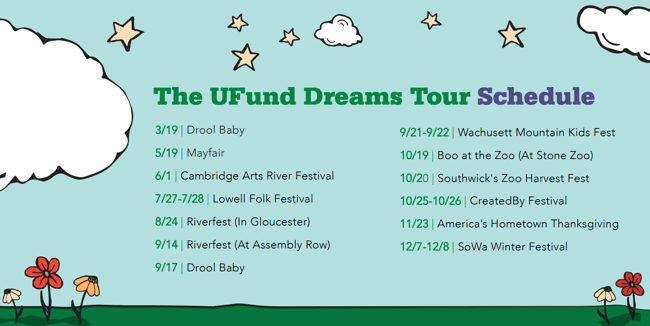

MEFA and Fidelity will be at a few more events this Fall, so go visit them if you’re in the area! SoWa is one of my personal favorite events, especially for holiday shopping!

Thank you to MEFA and Fidelity Investments for sponsoring this post. All opinions, as always, are my own!

Leave a Reply